The recent Amaranth hedge fund implosion reinforces our view that the current financial markets are speculative and valuations are driven by the extraordinarily loose monetary policy around the world since 2000. We believe that Federal Reserve Chair Bernanke’s pause in monetary tightening was premature and inflation will continue its upwards creep, even with a slowing economy and falling commodity prices. This should put pressure upwards on bond yields in the months ahead.

Money is Not Scarce

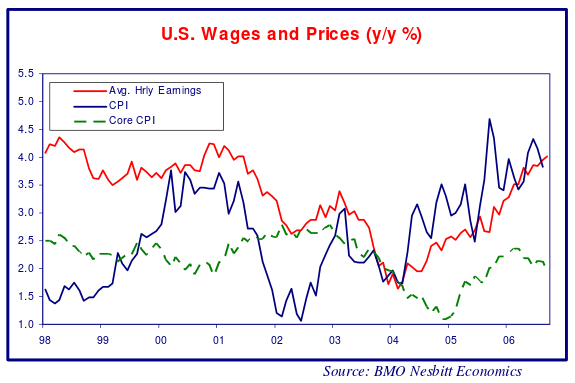

In our modern credit driven society, it is very difficult to seize on one monetary aggregate as the universal true measure of monetary conditions. Our defense against confusion is to keep things simple and observe the economy and financial markets. Inflation is caused by individuals and businesses being able to pay higher prices for things they deem necessary. We see no signs at present of a scarcity of money or credit. To the contrary, rising wages and prices reflect an ample supply of whatever a modern citizen uses for payment be it credit, debit or an ATM linked home equity line. As the chart below shows, U.S. wages and prices have been in a sharp uptrend since 2004.

This is the concern of the Governor Lacker, the lone dissenter on the Federal Reserve Open Market Committee decision to keep the Fed Rate at 5.25%. In the absence of accommodating monetary policy, the sharp increase in commodity and energy prices over the past two years would have to have been accommodated by falling prices in other goods. This was the argument of the bond market bulls who felt that high energy prices were bullish for bond yields in 2005. The fact that U.S. prices and wages are currently rising sharply indicates that monetary policy has not in fact been restrictive. Mr. Bernanke has paused to see if the prior Fed Rate increases have begun to work. This risks a more severe approach if the troubling increase in wages and prices continues.

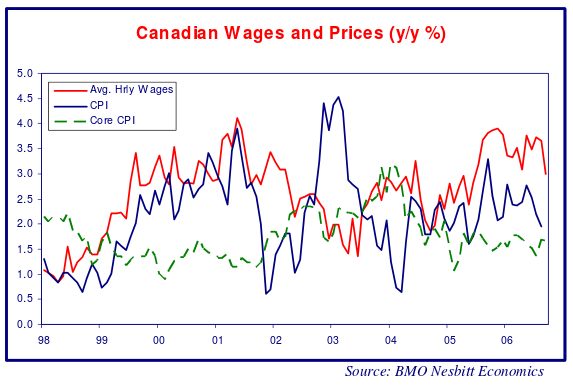

The Canadian inflation picture is better than that in the U.S. due to the sharp appreciation in the Canadian dollar, as the chart below shows. With the Canadian CPI near 2%, the maximum target of the Bank of Canada and wages rising above 3%, there is little room for error by the BOC. The red hot economy in Alberta is causing a labour shortage that has broadened across the other provinces. This will keep pressure up on wages.

The shameless scramble by investors to buy anything that promises income is also proof positive of ample liquidity. In the corporate bond market, our small corner of the global financial system, we watch the succession of expensive corporate bond new issues and bank loans to weak credits and wonder at those who consider monetary policy tight and money scarce.

On this basis, we think that forecasts of serious economic weakness are premature. We expect the U.S. economy to muddle through for a period with the other world economies pulling it along with their demand for U.S. exports. Given our outlook for a U.S. economy that muddles through, we are not bullish on the bond market. A preemptive bond market rally has already occurred. Bond investors have been conditioned in a Pavlovian manner to go long at the faintest hint of a slowing economy or Fed ease. This time around, the Bernanke “pause that refreshes” combined with some weaker economic readings to send bond investors into a feeding frenzy. Fear of missing a rally and the approaching quarter end sent bond prices soaring in the U.S., dropping the long yield from 5.3% at June 30th to 4.7% at September 30th.

How Low Can Long Yields Go?

Since inflation doesn’t seem to be dropping and wage gains are running at high levels, we wonder how much lower that long-term bond yields can go. It looks to us like inflation, both core and face will be stubbornly in the 2-3% range going forward. Our valuation suggests that longer term bonds are expensive, given expected inflation and historical norms.

This, as we have discussed in our prior reports, combines with experienced historical yields and current inflation-linked bond yields to suggest short yields in the 4-5% range and long yields above 5% in the U.S. The current 4.7% yield on the U.S. long Treasury bond incorporates a sustained drop in inflation from current levels.

Our value orientation means that it is hard for us to assume term and duration risk when we are not currently compensated for doing so. Even if the economy does weaken significantly and inflation drops below 2%, we believe that short and mid-term bonds should provide better value. It is at times like this that we appreciate our corporate bond emphasis that frees us from the need to predict exact movements of interest rates.

A Tale of Yield Woe

On the subject of corporate bonds, however, we are not so sanguine. We continue to believe that current corporate bond yield spreads are woefully inadequate to compensate for the huge risks that we see lurking beneath the calm credit picture. Overall, corporate bond yield spreads have widened a little but are still far below historical averages.

In Canada, we turn to the long end of the corporate bond market for evidence of excess. Showing our ages, we remember when it was hard to issue a BBB corporate bond in Canada. Now, after a long period of narrowing bond spreads and falling default rates, we are seeing a very high level of BBB rated corporate issuance. This includes substantial long BBB issuance which is unprecedented in the Canadian market. A large chunk of the recent issuance has been rated BBB (low), which is the lowest rating in investment grade.

Longing For Sobeys

The buyers of the new long Sobeys 5.79% of 2036 issue rated BBB (low) must be more confident about the competitive pressures in the Canadian grocery industry than most. We recall the mid-term Sobeys issues that widened to nearly 3% in the bear corporate bond market from 2000-2002. With Wal-Mart and Loblaws set to battle it out for Canadian “Big Box” grocery supremacy, Sobeys could very well be sideswiped with substantial collateral damage. Starting out at BBB (low), the upside for investors holding the Sobeys long issue is payment of the promised 1.7% in additional yield, even given an upgrade. The downside is a drop below investment grade and a fairly hefty spread widening.

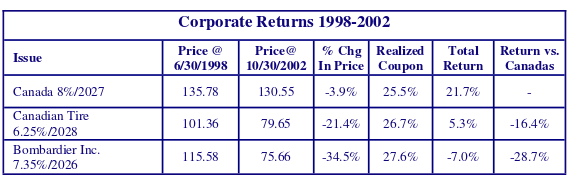

What concerns us is that the enthusiastic buyers of these issues do not truly understand the risks that they are assuming. When a long-term corporate bond widens in yield spread, the results can be disastrous for the bondholder. We are reminded of the rash of long issuance at the peak of the last corporate bond cycle in 1998. Buyers happily stepped up to buy long Canadian Tire and Bombardier Inc. bonds at very low yield spreads compared to Government of Canada bonds.

Long Bombs?

By the bottom of the corporate bond market in October 2002, the investors in these issues had been paid the promised coupon but suffered dramatic capital losses as yield spreads increased substantially. The returns on these corporate issues were much lower than investing in comparable long-term Government of Canada bonds as the table below shows. Investors in Canadian Tire bonds lost 16.4% and Bombardier investors lost 28.7% compared to holding a long Canada bond over the period ended October 2002.

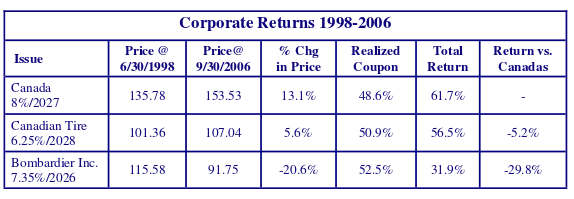

Considering these bonds still trade at much wider spreads, the holders of these bonds would still be better off in Canada issues in 2006, even given the additional yield they have received over the eight years since issue, as the table below shows. In the period between 1998 and 2006, holders of Canadian Tire bonds were 5.2% and Bombardier bonds 29.8% behind just having held a long Canada over the period.

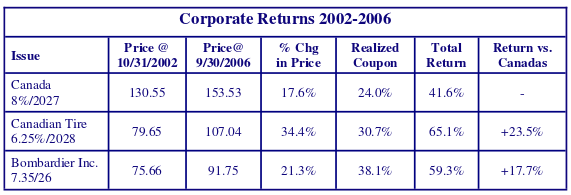

Of course timing is everything in life and investments. At Canso we invested in the Canadian Tire and Bombardier long bonds near their market lows. The table below shows the substantial out-performance of these corporate issues since 2002. Caution and patience was rewarded with substantial gains.

Better Safe Than Sorry

The market appetite for long-term BBB (low) bonds is another sign to us of the frothiness of the corporate market. We are watching the current hot issues from the sidelines. We think the missed upside will be modest and we will avoid what we believe is significant downside.

The current headlong rush to assume credit risk in long corporate issues for very little extra compensation is a sign of a market peak. It might not occur in the next few weeks over even months but the seeds of the next downturn are being planted with each overpriced new issue. It is better to be safe than sorry in today’s corporate bond market.